child tax credit payment dates november 2021

For months where the first day falls on a weekend or holiday the payment date is the last business day of the previous month. The payment dates for AISH were recently updated to the first of the month.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Note that the Educational Opportunity Tax Credit EOTC may be claimed for tax years beginning on or after January 1 2008 and not later than December 31 2021.

. February 1 2022 February benefit March 1 2022 March benefit. Tax filing companies like TurboTax HR Block and Jackson Hewitt are offering early tax refund advance loans for 2021 2022. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

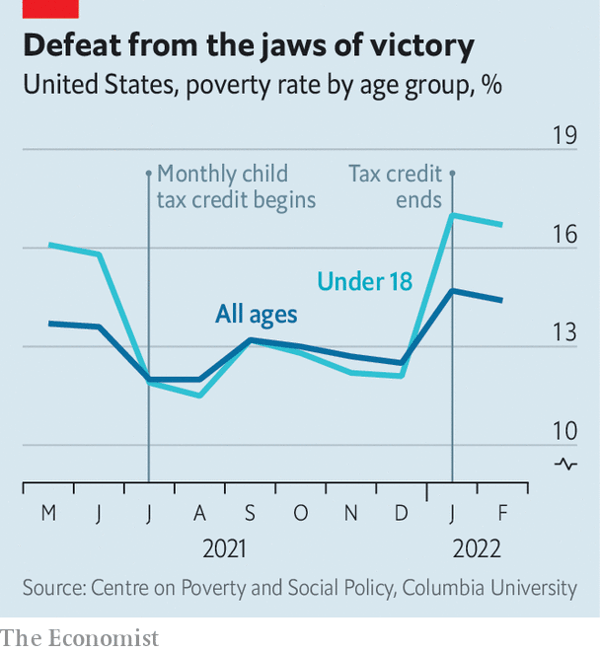

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. Got their first payment on July 15 2021.

AISH Payment Dates 2022. The Child Tax Credit Update Portal is no longer available. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. The remaining AISH payment dates in 2022 are. The deadline to sign up for monthly Child Tax Credit payments this year was November 15.

The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start. Of their 2021 Child Tax Credit as monthly payments of. These 0 interest rate loans usually start before the Christmas holidays and range from 250 to 4000.

For tax years beginning on or after January 1 2022 the EOTC is replaced by the Student Loan Repayment Tax Credit SLRTC.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Child Tax Credit Toolkit The White House

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Will There Be Another Check In April 2022 Marca

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet